Aside from membership, do you know the most valuable products your association offers? When we refer to products here, we are talking about products, services and content. Many organizations measure the success of their products by aggregate revenue, engagement numbers, and member feedback. Those traditional metrics are a good starting point, but often do not tell the whole story.

You need to look behind the scenes to get the real answer to the question “What products are most valuable?”

As we discussed in our recent blog post about retention, data isn’t one dimensional. There are many different factors to consider when assessing the true value of your products. For example, by looking beyond the sales numbers of an individual product and instead considering a market basket analysis (which product sales frequently occur together), you can gain important insights that would have been missed if the analysis stopped at the single product. Considering the data more broadly will help you track trends over time, determine the lifetime value of a member, identify overlapping behaviors, take action to invest more or less in your product offerings, and maximize your return on investment.

Data can help you think more broadly to identify a valuable product based on your specific goals and success metrics. Consider these key questions as you assess your product’s value:

How much revenue is it generating and how many units have been sold?

Are you selling a smaller number of high-priced items vs. higher volume of sales at a lower price point? Which scenario is most valuable to you: you sell a very high-priced item and the member doesn’t engage again after that or you sell a ton of lower-priced items that lead to repeat traffic or more engagement? Understanding post-purchase behavior is an important part of the analysis.

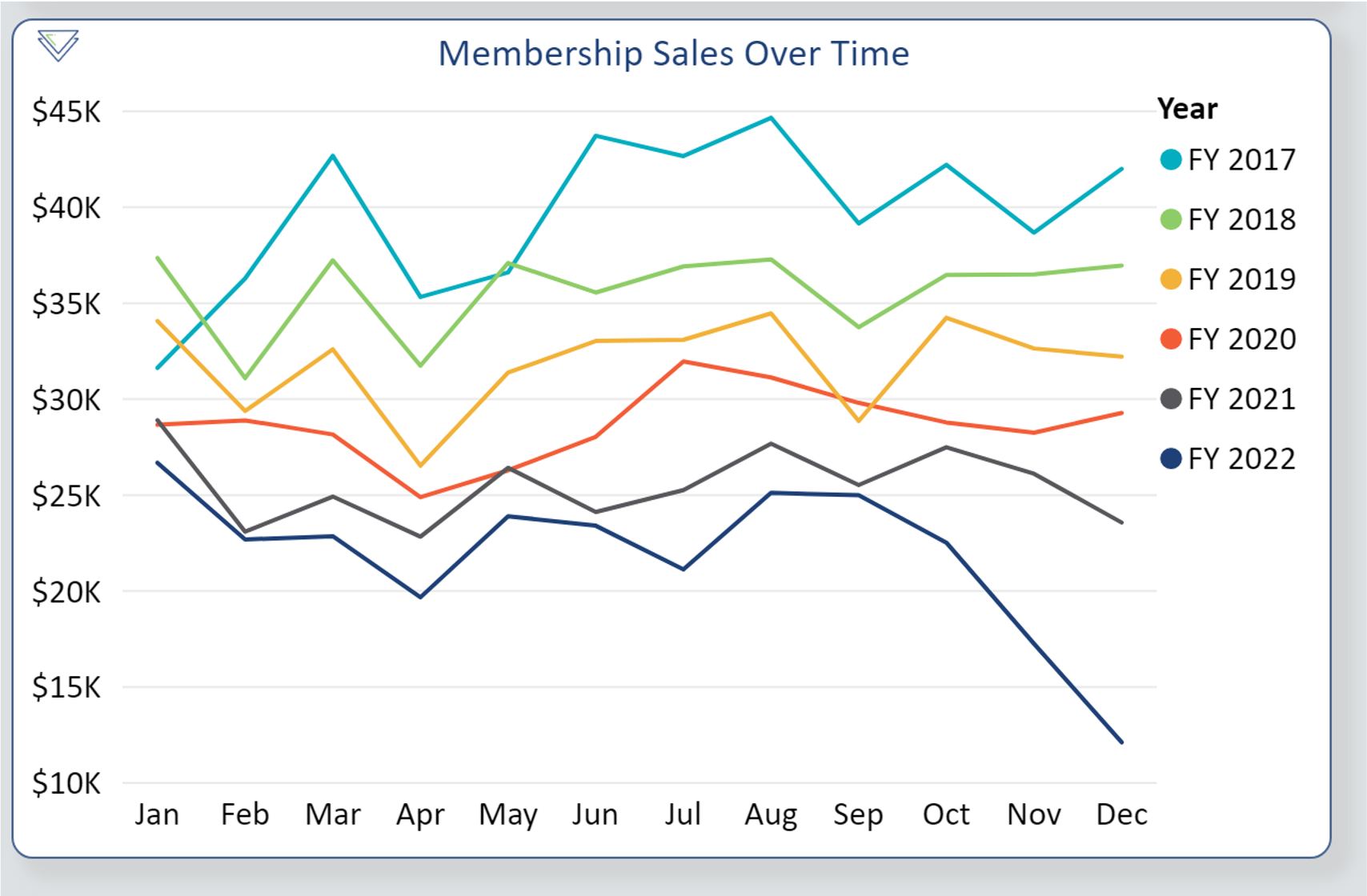

What is the trend in sales over time?

Don’t just look at your sales at a point in time. Track sales trends over time to see if a product becomes more or less popular. A product that was a big revenue driver a year ago, may have lost its appeal. Are your sales seasonal? Do they increase around an event like your annual meeting?

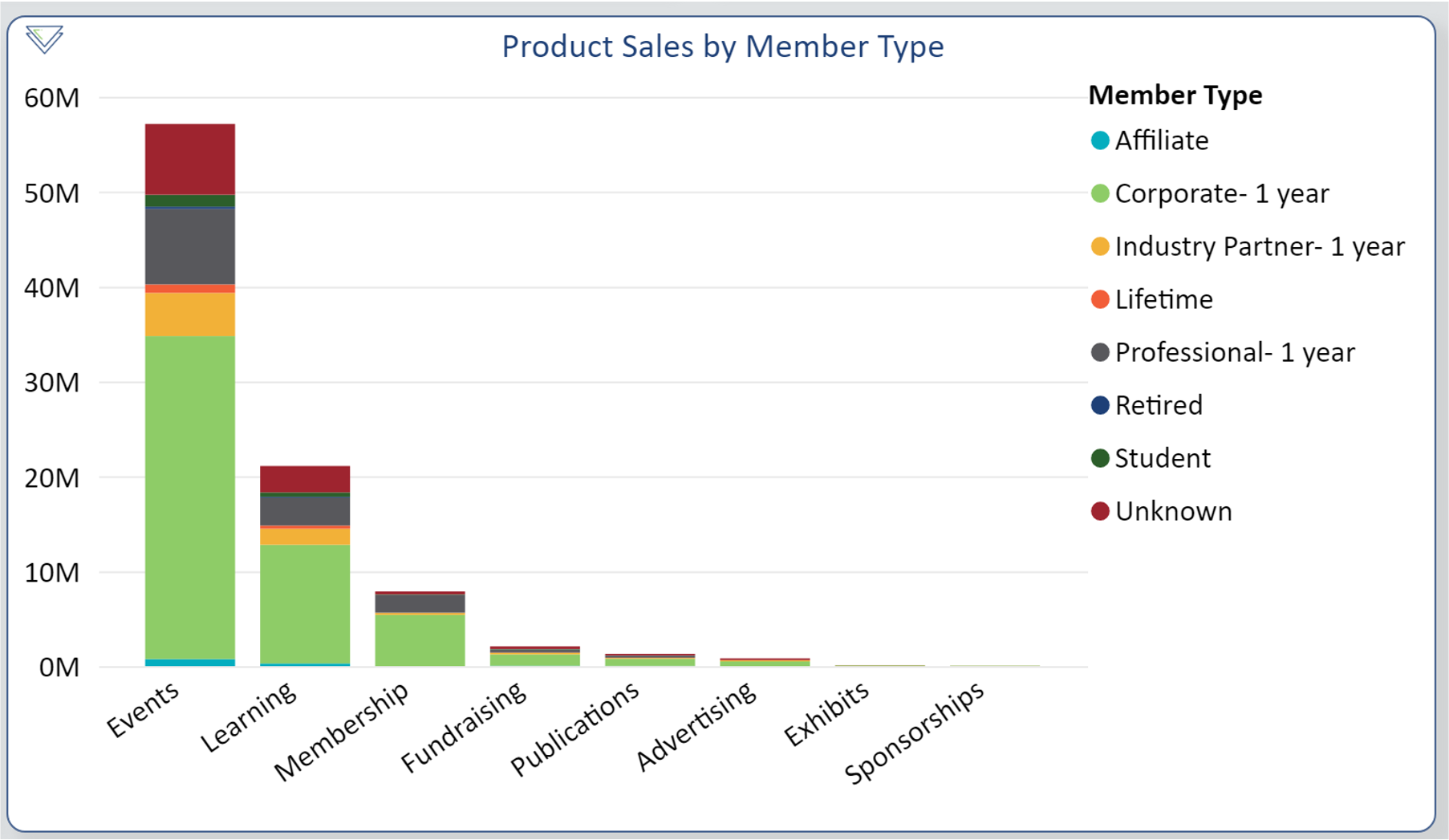

Who are the most likely buyers for this product?

What other products are members purchasing when they purchase this product?

Is there a correlation with behavior? For example, members who buy a certain book also take a specific course related to the book which leads to them getting a certification. Although the initial product purchased wasn’t the most lucrative item, the purchase ultimately led to increased revenue and engagement with other products. Do you have many dead end products – ones that don’t lead to any other purchases or engagement?

What is my capacity?

You should assess what resources you have to produce each product. With knowledge that certain products are more valuable, you can prioritize limited resources to work on those. Or, justify if the time and money spent on a particular product contributes to the future health of the organization.

What are the COGS (Cost of Goods Sold) per unit?

This is a very important data point in your overall valuation assessment to determine if you are getting a profitable ROI. Is there a cost associated with the product and are you making enough revenue from it to offset that cost? Remember to consider the staff time required to deliver the product. This is a cost often overlooked and one that can tip the scales of profitability. Lastly, don’t forget that costs aren’t always linear and can sometimes jump up by a step-factor when certain thresholds are hit. For example, if a team is already at capacity, creating one extra product may mean you need to hire an additional staff member to deliver it.

Should we invest more or less in this product?

Considering all of these factors together can help guide where you should invest your resources. The data analysis will help you determine a product’s long-term sustainability, as well as which products to invest more resources and money into and which products you should sunset. Maybe it is time to introduce something new.

Other examples of how you can put this data to use include:

- Bundling: By analyzing which products tend to be purchased together, you can test offering a bundle of products to see if that leads to more engagement or sales.

- Tracking Behavior: The data shows that a certain member segment who purchase product “A” also purchase product “B.” You can identify which members in that segment haven’t purchased “B” yet and test offering them a discount to see if it increases sales.

- Look at Sales on a Granular Level: You see that online courses are a larger revenue generator. By looking at sales data at a granular level, not just by category, you can see if one or a few courses are driving this traffic. This can help you determine which courses to market more heavily and which to sunset.

- Product Recommendations: As you may have experienced yourself, when you make an online purchase, a retailer often shows you other items people like you have purchased. You can do the same with your members. If you see that someone who buys a training course overlaps with members who are attending your annual meeting, you can promote the meeting to that member after their training purchase.

As you can see, there are many more considerations beyond individual product sales and survey feedback when it comes to evaluating your products. We encourage you to dig into your data and look at your products through a more comprehensive lens. It takes a bigger investment in time, but the payoff will be worth it when your resources (time, energy and dollars) are focused on the most high-value products.

If you’d like to learn how our data analytics platform, Acumen, can help you easily perform these types of product analyses, don’t hesitate to schedule a demo.

Or you can check out the “how-to” webinar about this topic here.